By Mark Majewski

Canada’s electronics development and manufacturing industry needs to up its game.

But how do we compete against powerhouses like the U.S., China, India or Japan?

By looking at:

- Where there are new opportunities with emerging technologies to create an industry that is also more eco-friendly and adaptive.

- What new products and applications are being developed for niche markets with big growth potential.

- How we can stem the tide of electronics development, prototyping and high-volume automated manufacturing activity that continues to head offshore and repatriate some of this work back to Canada.

The FHE advantage

The emerging flexible and hybrid electronics (FHE) sector offers Canada an unprecedented opportunity to deliver on all these goals. It represents billions of dollars in new opportunity for electronics manufacturers to drive industry momentum and create more high-value jobs.

FHE represents a new set of additive manufacturing methods that can be far more eco-friendly and cost-efficient than conventional subtractive processes. These include 2D large area printable electronics, flexible integrated circuits, 3D printable electronics for multi-layer PCBs, in-mould electronics and adding functionality to the surfaces of 3D objects. It encompasses conductive yarns which can be used to create smart garments, as well as thin-film integrated circuits and semiconductors.

The Canadian opportunity

Over the past several months, our team undertook some digging to quantify the size of Canada’s domestic electronics manufacturing industry. In the process of this, it became apparent that intelliFLEX is the only industry alliance in Canada with a singular focus on driving electronics design, development and manufacturing across the country.

Today, we unveil the outcome of this research with an infographic that profiles the domestic industry.

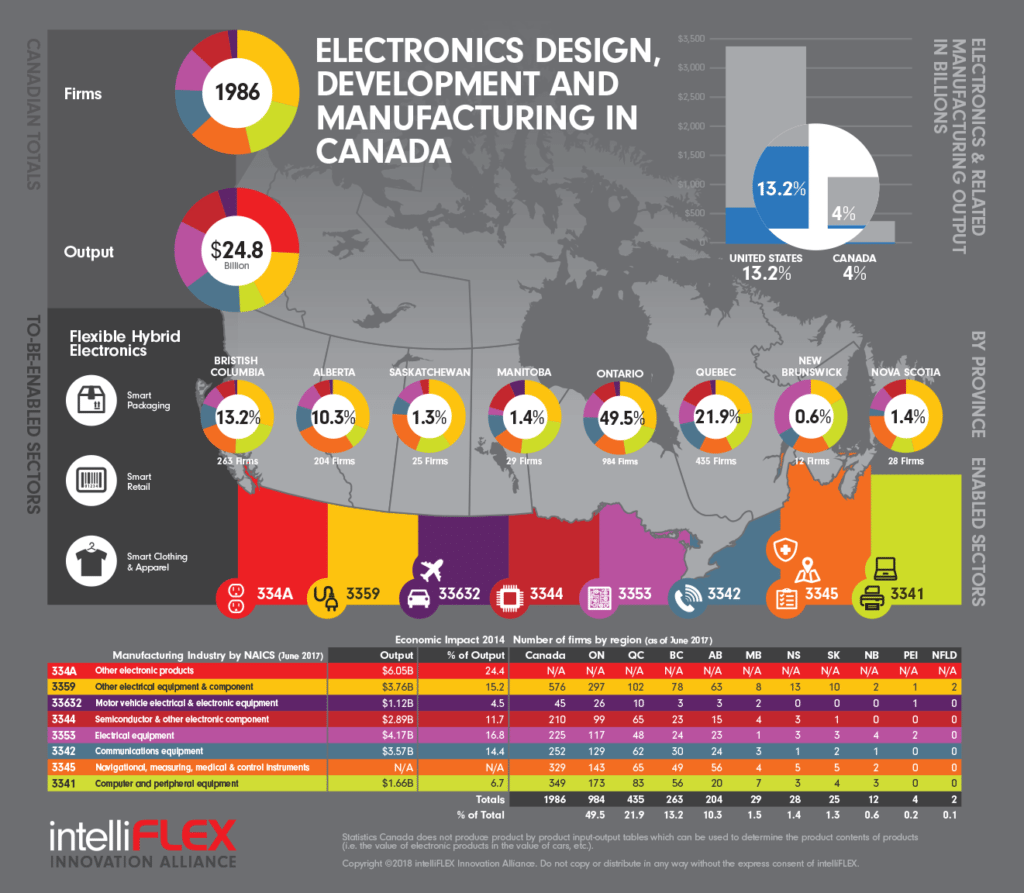

According to data compiled by Canadian Manufacturers and Exporters, electronics and related manufacturing represented about four per cent of Canada’s total manufacturing output in 2015 (or $24.8 billion of $620 billion, according to CME’s Industrie 2030 report from 2016).

Compare that to a fellow G7 nation like the U.S. where the figure is more than triple that, at around 13.2 per cent ($364.56 billion of $2.77 trillion in total manufacturing output), according to 2015 data from the Center for Manufacturing Research (converted to CDN dollars using exchange rate of 1.279163).

Almost 2,000 domestic companies are engaged in electronics, computers and related manufacturing, according to Statistics Canada. Fifty per cent are located in Ontario and about 22 per cent are in Quebec, with 13.2 per cent in British Columbia and 10.3 per cent in Alberta.

These are the firms we already have that could drive the growth of Canada’s FHE manufacturing sector globally.

And this is just the tip of the iceberg

Companies that already produce electronics and electrical components for established end use markets represent only the tip of the proverbial iceberg when it comes to FHE.

Our data doesn’t take into account other large Canadian manufacturing sectors that stand to benefit from the adoption of new additive processes to add intelligence and new levels of functionality to everyday objects for the Internet of Everything.

These include packaging, textiles, residential and commercial real estate, and other parts and systems for industrial equipment and transportation that currently do not incorporate electronic components.

Nor have we included in this data the software development sector, which has a crucial role to play to create the cloud-based applications and platforms necessary to enable this added functionality with the related data collection and analysis. (We have excluded this sector because sufficiently granular data was not available from Statistics Canada to present an accurate overview of the size of this industry in Canada as it pertains to FHE.)

In addition, we haven’t included the academic and public research institutions that carry out the basic and applied research in FHE, or the hundreds of startups and spin-off companies across Canada that are pursuing new commercial products and applications. They are a vital part of the domestic ecosystem and competitive strengths for Canada on the global stage.

Our work continues

With all the headlines these days focusing on the risk of a trade war with the U.S. and an uncertain future for NAFTA, it’s time for Canada to look at how it can boost its economy in new ways and into new markets.

As part of the Advanced Manufacturing Supercluster, and with partners like Canadian Manufacturers and Exporters, intelliFLEX will continue to advocate the adoption of FHE technologies. Our focus will be on key sectors of Canada’s manufacturing industry, from well-established areas like automotive and aerospace, to new emerging applications such as AI, IoT and digital.

The advanced manufacturing sector, now more than ever, is critical to the success of the Canadian economy. FHE represents a valuable new market opportunity, both for manufacturers outside of the traditional electronics supply chain, and for existing electronics manufacturers in need of a new competitive edge.